Good morning 2025!

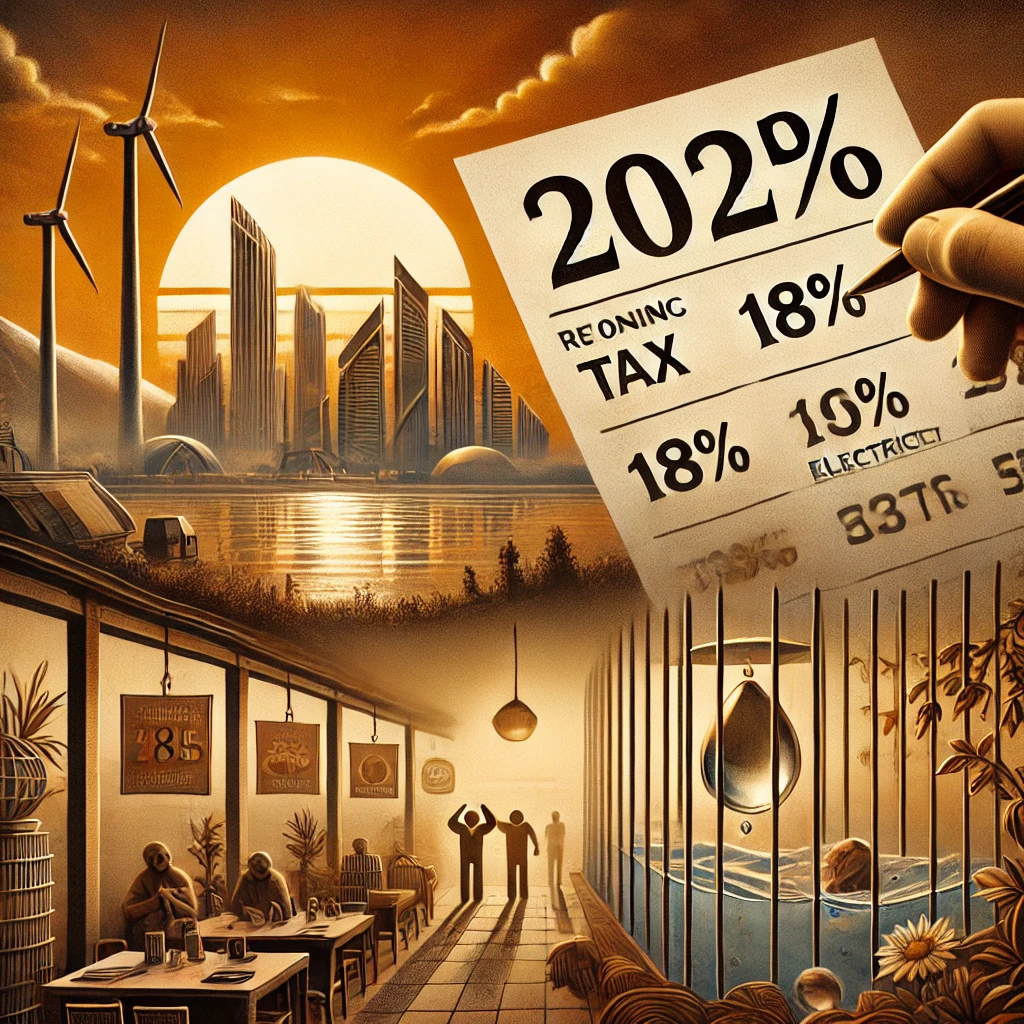

As we welcome 2025, it’s a time of mixed emotions. The new year brings with it a series of economic challenges that will impact households across Israel.

Economic Challenges Ahead

Starting January 1st, several financial measures are set to take effect:

- Value Added Tax (VAT) Increase: The VAT rate will rise from 17% to 18%, affecting the cost of goods and services nationwide.

- Income Tax Adjustments: Income tax brackets will be frozen, potentially leading to higher tax liabilities for many. Additionally, certain tax credits and child allowances are expected to be reduced.

- Utility Price Hikes: Electricity and water rates are slated to increase, further straining household budgets.

- Municipal Taxes: Property taxes (Arnona) are set to rise, adding to the financial burden on homeowners and renters alike.

These measures are part of a broader austerity budget aimed at addressing the economic strains resulting from ongoing conflicts and a slowing economy.

Beyond economic issues, security challenges persist:

- Hostages in Gaza: Approximately 100 Israeli citizens remain captive in Gaza, with efforts to secure their release ongoing but facing significant hurdles.

- Regional Threats: The threat of rocket attacks from groups such as the Houthis in Yemen has increased, leading to heightened alerts and occasional disruptions in daily life.

Looking Forward

While the new year presents significant challenges, it also offers an opportunity for resilience and unity. Addressing these economic and security issues will require collective effort and determination.

As we navigate 2025, staying informed and prepared will be crucial. By understanding the changes ahead, we can better adapt and support one another through these trying times.